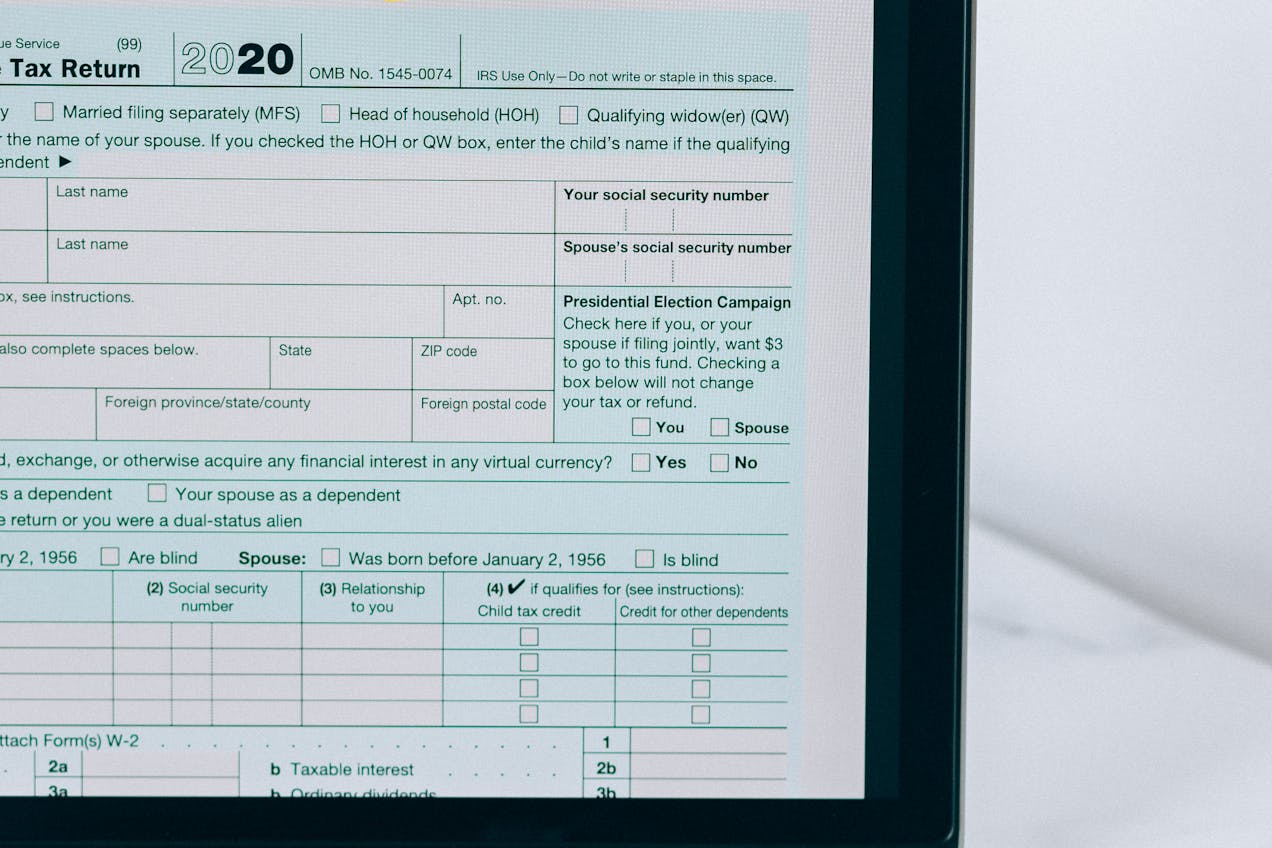

Did you know that failing to file IRS Form 5472 can result in hefty fines and penalties? For U.S. business owners living abroad, understanding this crucial form is essential...

In the fast-paced world of e-commerce, tax compliance can feel like navigating a minefield. From sales tax to international regulations, e-commerce businesses face unique challenges that can have significant...

Are You Overlooking This Critical Aspect of E-commerce Tax Compliance? In the bustling world of e-commerce, managing inventory efficiently is crucial for ensuring tax compliance and optimizing profitability. Many...

Are You Maximizing Your International Company’s Tax Efficiency? In the global business landscape, structuring your international company for tax efficiency can significantly impact your profitability and compliance. Are you...

Are You Making These Costly E-commerce Tax Mistakes? Running an e-commerce business is exciting and full of opportunities. However, navigating the complex world of taxes can be daunting. Many...

Simplify Your Business Obligations Are you an entrepreneur or a business owner with a company registered in Delaware or Wyoming? Have you ever found yourself tangled in the maze...

Running a business is challenging enough without having to navigate the maze of annual compliance requirements for your LLC. Whether you have chosen Delaware or Wyoming as your LLC’s...

Did you know that failing to file Form 5472 correctly can cost your business a staggering $25,000 in penalties? For foreign-owned U.S. corporations, navigating the complexities of Form 5472...

Choosing the right state to form your LLC can save you thousands in taxes and legal fees. Delaware and Wyoming are the top contenders, but which one is truly...

Don’t Let IRS Form 5472 Become Your Business’s Achilles’ Heel! Dealing with the complex landscape of IRS regulations can be a daunting task for any business owner, especially when...