Did you know that failing to distinguish between IRS Form 5472 and Form 5471 can lead to significant penalties and compliance issues? Many U.S. business owners and expatriates struggle...

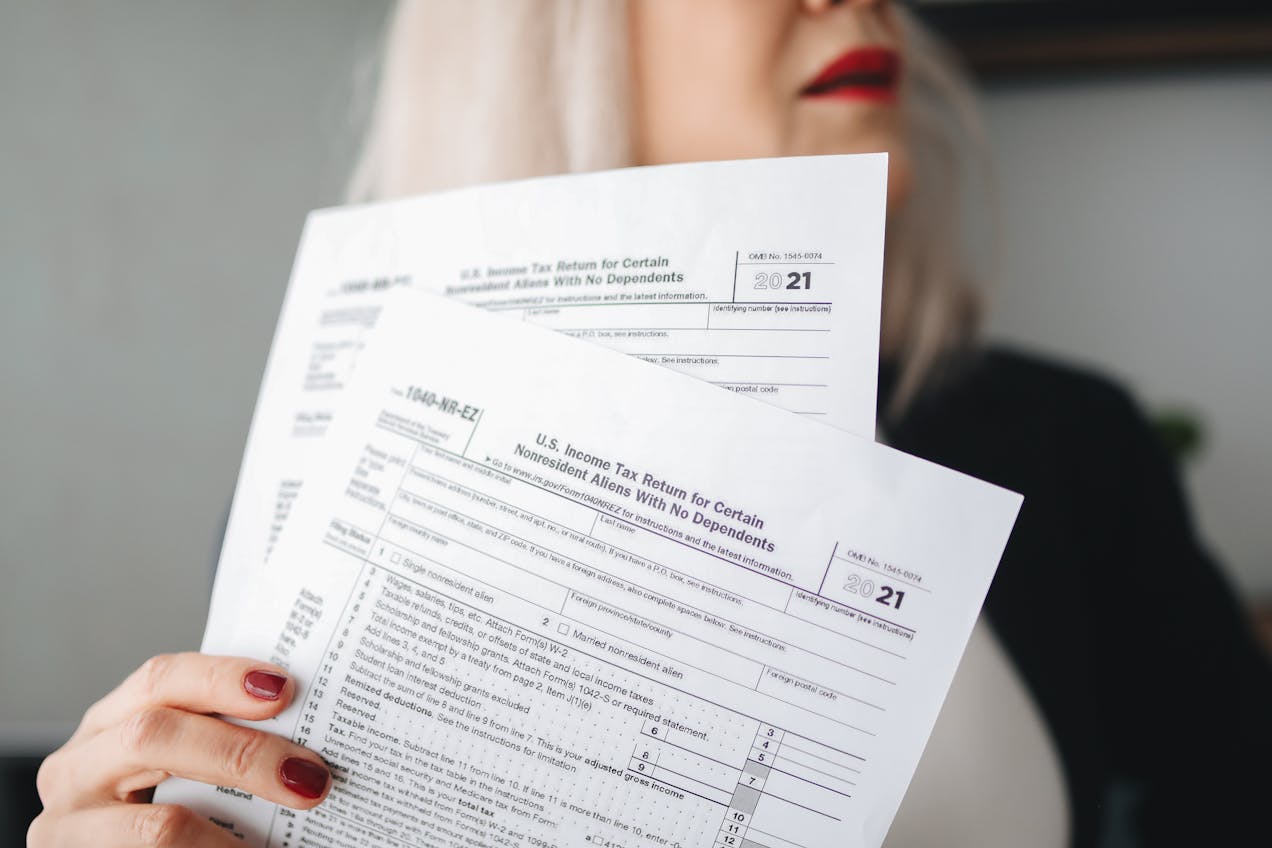

Did you know that failing to file IRS Form 5472 can result in penalties of up to $25,000? Foreign-owned U.S. corporations are often caught off guard by this requirement,...

Are you a U.S. business owner with foreign shareholders or significant transactions with foreign entities? Then you know that staying compliant with IRS regulations can be a complex and...

IRS Form 5472 is required for reporting transactions between a US corporation and its foreign shareholders. This form is crucial for maintaining compliance with US tax regulations, as it...

In today’s digital age, maintaining privacy for your business is more critical than ever. For U.S. residents living abroad and those involved in the intricacies of tax and regulatory...

Are you aware of how the tax laws in Delaware and Wyoming can significantly impact your business? Whether you are a business owner, CPA, or attorney, understanding the nuances...

Are You Maximizing Your LLC’s Tax Benefits? For business owners with LLCs in Delaware or Wyoming, understanding effective tax planning strategies can be the key to significant savings. Both...

Are you planning to start a business and wondering whether to incorporate in Delaware or Wyoming? These two states are known for their business-friendly environments, but each has its...

Did you know that failing to file IRS Form 5472 can result in hefty fines and penalties? For U.S. business owners living abroad, understanding this crucial form is essential...

In the fast-paced world of e-commerce, tax compliance can feel like navigating a minefield. From sales tax to international regulations, e-commerce businesses face unique challenges that can have significant...