Simplify Your Business Obligations Are you an entrepreneur or a business owner with a company registered in Delaware or Wyoming? Have you ever found yourself tangled in the maze...

Running a business is challenging enough without having to navigate the maze of annual compliance requirements for your LLC. Whether you have chosen Delaware or Wyoming as your LLC’s...

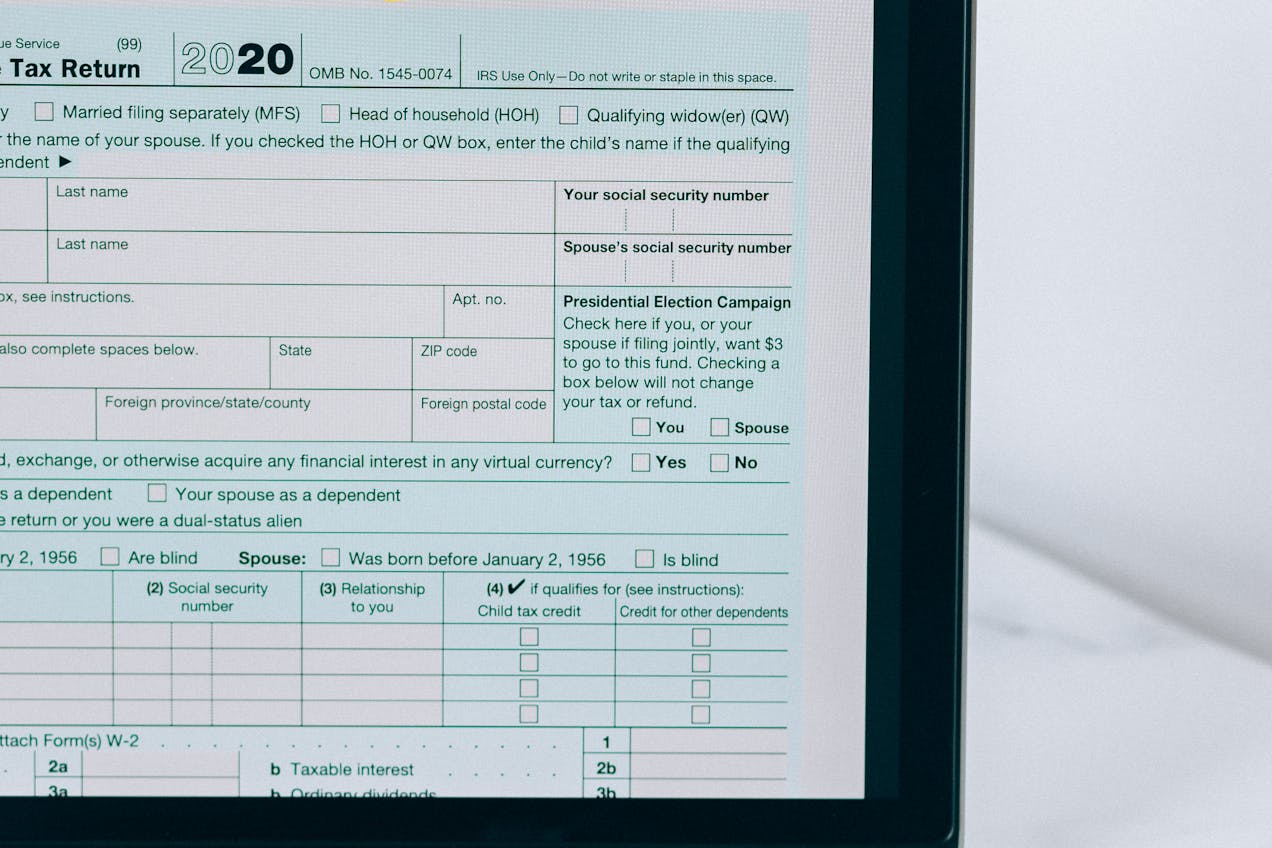

Did you know that failing to file Form 5472 correctly can cost your business a staggering $25,000 in penalties? For foreign-owned U.S. corporations, navigating the complexities of Form 5472...

Ready to launch your business but overwhelmed by where to start? Forming an LLC in Delaware or Wyoming could be the game-changer you need! These states are known for...

Choosing the right state to form your LLC can save you thousands in taxes and legal fees. Delaware and Wyoming are the top contenders, but which one is truly...

Protect Your Business from Devastating IRS Penalties – Learn About Form 5472 Compliance Now! Filing IRS Form 5472 correctly and on time is crucial for businesses with foreign ownership....

Don’t Let IRS Form 5472 Become Your Business’s Achilles’ Heel! Dealing with the complex landscape of IRS regulations can be a daunting task for any business owner, especially when...

Thinking of forming an LLC? You might want to consider Delaware or Wyoming. These states offer unique advantages that can save you time, money, and legal headaches. Whether you’re...

Don’t Let IRS Form 5472 Catch You Off Guard – Learn Who Must File! Dealing with the complexities of IRS regulations can be challenging, especially when it comes to...

Don’t Let These Common Mistakes Derail Your IRS Form 5472 Filing! Filing IRS Form 5472 can be a complex and daunting process for businesses with foreign ownership. Even minor...