Introduction Did you know that the Tax Cuts and Jobs Act (TCJA) introduced significant changes to the filing requirements of IRS Form 5472? These changes have major implications for...

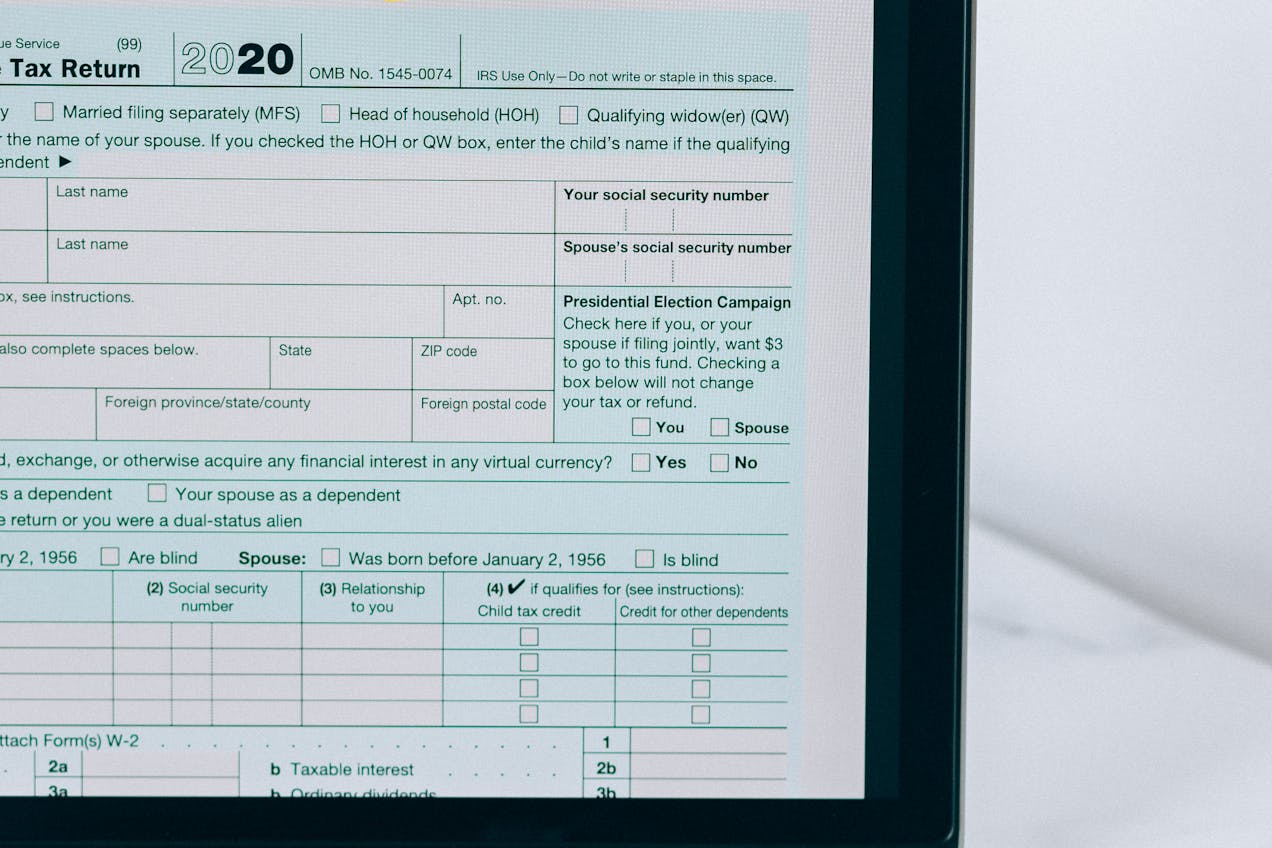

Navigating the maze of IRS Form 5472 can feel like a daunting task, especially for US residents living abroad. The complexities of this form, which is essential for reporting...

Navigating the complexities of IRS Form 5472 can be a significant challenge for multinational corporations. The stakes are high, with strict compliance requirements and hefty penalties for errors. But...

Ever wondered how to keep your Delaware or Wyoming LLC in good standing? Maintaining your LLC’s status is crucial to avoiding fines and penalties, and ensuring smooth business operations....

As a US resident living abroad, navigating the intricacies of IRS Form 5472 can be a daunting task. This critical form is essential for reporting transactions with foreign-owned businesses...

Thinking of forming an LLC in Delaware or Wyoming? These states are popular for their business-friendly environments, but understanding the legal framework is crucial to making an informed decision....

Did you know that your LLC’s success could hinge on a registered agent? This often-overlooked aspect of forming a Delaware or Wyoming LLC is crucial for maintaining compliance and...

Foreign investors in U.S. businesses must prioritize IRS Form 5472 compliance. This form reports specific transactions between U.S. corporations and foreign shareholders, ensuring transparency in financial activities affecting U.S....

Are you a business owner considering forming an LLC in Delaware or Wyoming? Maybe you’ve heard these states are tax havens with friendly business environments. But do you know...

Did you know that failing to distinguish between IRS Form 5472 and Form 5471 can lead to significant penalties and compliance issues? Many U.S. business owners and expatriates struggle...