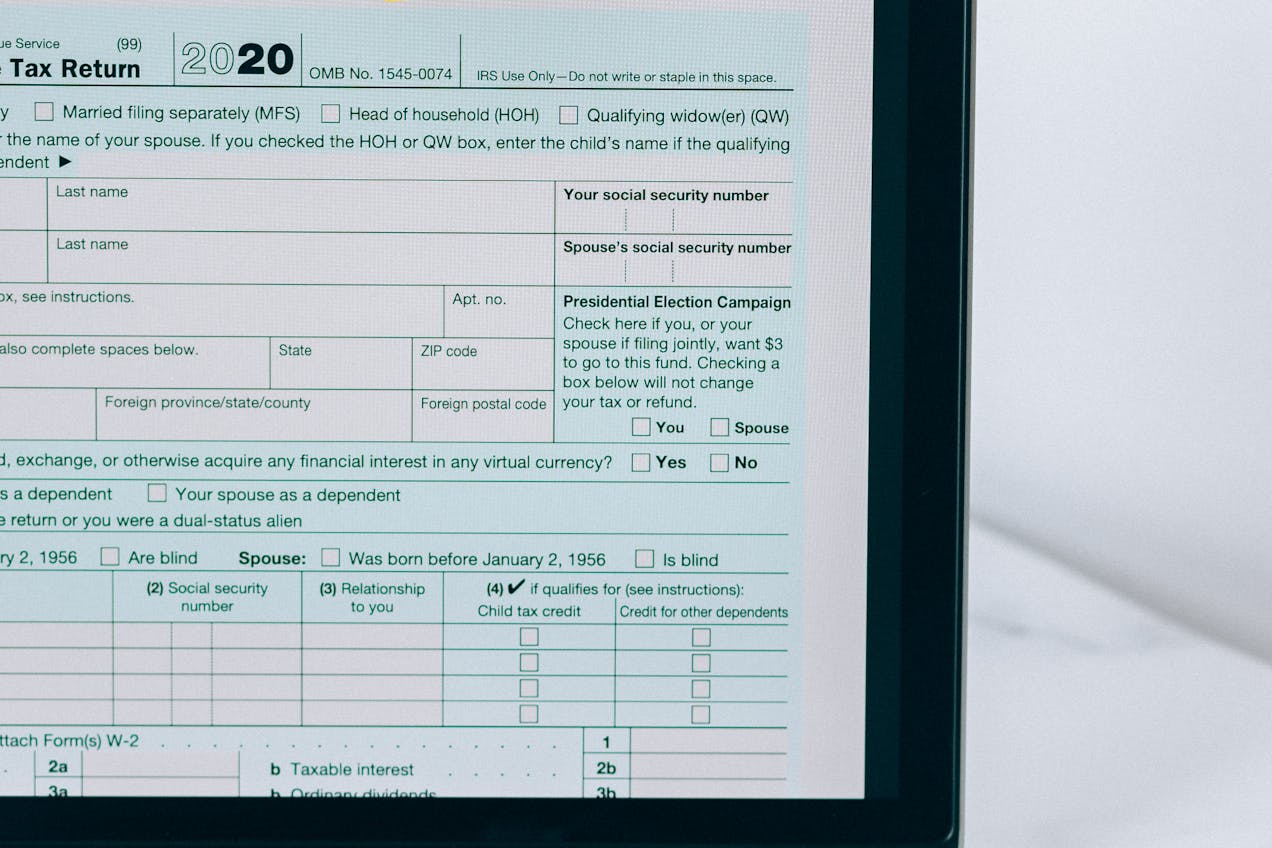

Introduction Did you know that the Tax Cuts and Jobs Act (TCJA) introduced significant changes to the filing requirements of IRS Form 5472? These changes have major implications for...

Did you know that failing to distinguish between IRS Form 5472 and Form 5471 can lead to significant penalties and compliance issues? Many U.S. business owners and expatriates struggle...

Did you know that failing to file IRS Form 5472 can result in penalties of up to $25,000? Foreign-owned U.S. corporations are often caught off guard by this requirement,...

Did you know that failing to file IRS Form 5472 can result in hefty fines and penalties? For U.S. business owners living abroad, understanding this crucial form is essential...

Protect Your Business from Devastating IRS Penalties – Learn About Form 5472 Compliance Now! Filing IRS Form 5472 correctly and on time is crucial for businesses with foreign ownership....

Don’t Let IRS Form 5472 Become Your Business’s Achilles’ Heel! Dealing with the complex landscape of IRS regulations can be a daunting task for any business owner, especially when...

Don’t Let IRS Form 5472 Catch You Off Guard – Learn Who Must File! Dealing with the complexities of IRS regulations can be challenging, especially when it comes to...

Don’t Let These Common Mistakes Derail Your IRS Form 5472 Filing! Filing IRS Form 5472 can be a complex and daunting process for businesses with foreign ownership. Even minor...

In the digital age, where cryptocurrency has become a significant part of our financial landscape, understanding how to navigate the complexities of crypto taxes is more important than ever....