Protect Your Business from Devastating IRS Penalties – Learn About Form 5472 Compliance Now! Filing IRS Form 5472 correctly and on time is crucial for businesses with foreign ownership....

Don’t Let IRS Form 5472 Become Your Business’s Achilles’ Heel! Dealing with the complex landscape of IRS regulations can be a daunting task for any business owner, especially when...

Don’t Let IRS Form 5472 Catch You Off Guard – Learn Who Must File! Dealing with the complexities of IRS regulations can be challenging, especially when it comes to...

Don’t Let These Common Mistakes Derail Your IRS Form 5472 Filing! Filing IRS Form 5472 can be a complex and daunting process for businesses with foreign ownership. Even minor...

In the intricate realm of tax compliance, overlooking a crucial regulation such as Form 5472 can thrust your business into a whirlpool of penalties and intricate legal challenges. For...

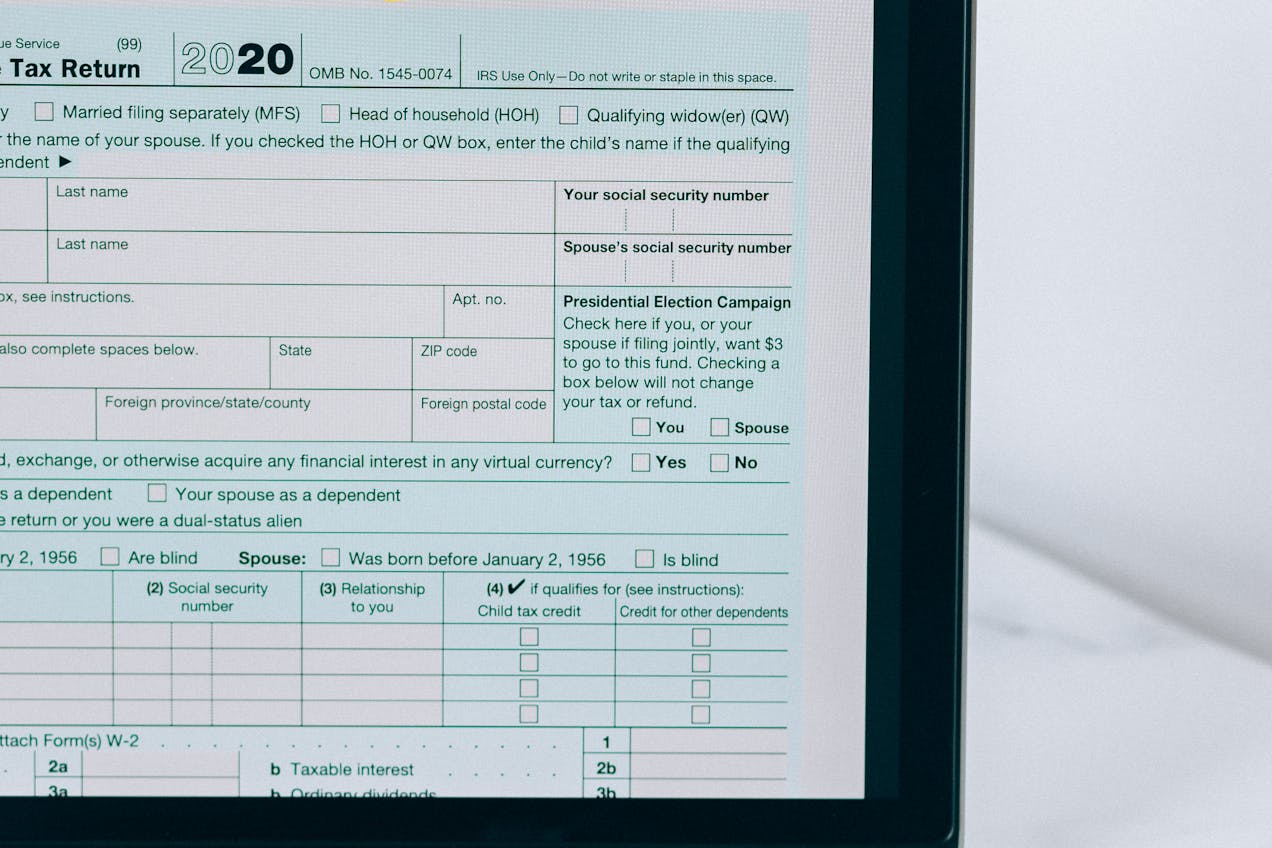

Reporting on Form 5472, an IRS tax form that requires disclosure of certain transactions between foreign-owned U.S. corporations or LLCs and their related parties, may seem straightforward. However, several...

When it comes to IRS reporting forms, navigating the complexities can be daunting, especially for US residents with international interests. One such form that often raises questions is Form...

In the fast-paced world of cryptocurrency, where fortunes can be made and lost in the blink of an eye, there’s one adversary that even the most savvy of traders...

In the dynamic realm of cryptocurrency, where the thrill of investment meets the complexity of tax regulations, many find themselves at a crossroads. The challenge? Accurately calculating gains and...

In today’s digital age, cryptocurrency has become a buzzword for innovation, freedom, and significant financial opportunity. Yet, amidst the excitement and gains, there’s a hidden trap that many overlook:...